Understanding Section 80C Benefits: ELSS vs Other Tax-Saving Options

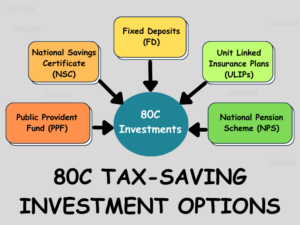

Tax-saving is a crucial aspect of financial planning, allowing individuals to maximize their savings while meeting long-term financial goals. Under Section 80C of the Income Tax Act, taxpayers in India can claim deductions of up to ₹1.5 lakh annually, making it one of the most popular provisions for tax savings. Among the many options available, […]

How to Use SIPs to Navigate Market Corrections and Rebounds

Market volatility can be intimidating for investors, but it also presents opportunities for wealth creation. Systematic Investment Plans (SIPs) are one of the most effective ways to navigate market corrections and rebounds. SIPs offer a disciplined and structured approach to investing, allowing you to benefit from market fluctuations rather than fear them. Here’s how you […]

Market Trends 2025: Best Mutual Fund SIPs for Long-Term Growth

Investing in mutual funds through Systematic Investment Plans (SIPs) has become one of the most popular strategies for wealth creation. As we step into 2025, changing market dynamics, economic recovery, and evolving investor preferences are reshaping the mutual fund landscape. If you’re looking to build long-term wealth, understanding the trends and selecting the best SIPs […]

Why Mid-Cap Mutual Funds Are the Talk of the Town

Summary Mid-cap mutual funds are gaining traction for their blend of growth potential and diversification. Investing in medium-sized companies, these funds offer higher returns than large-cap funds with moderate risk. Ideal for long-term investors and mutual funds SIP, they mitigate volatility through regular investments. With disciplined SIP strategies, mid-cap funds amplify wealth and ensure steady […]

The Rise of Sustainable Investing: ESG Mutual Funds in Demand

Summary ESG (Environmental, Social, and Governance) mutual funds are gaining popularity by combining financial returns with sustainability and ethical practices. Driven by climate awareness and demand for corporate accountability, these funds offer competitive returns, diversification, and positive societal impact. The Rise of Sustainable Investing: ESG Mutual Funds in Demand The investment world is undergoing a […]

Why Systematic Investment Plans (SIPs) Remain a Stable Choice in a Turbulent Market

In an ever-changing financial landscape, market turbulence is a constant. From geopolitical tensions to economic fluctuations, uncertainty often looms over investors. Amid such volatility, Systematic Investment Plans (SIPs) have emerged as a reliable investment avenue, helping individuals grow their wealth steadily. This article explores why SIPs continue to be a stable choice in turbulent markets […]

Adapting to Market Fluctuations: Tips for Long-Term Investors

Investing in financial markets is both exciting and challenging. The dynamic nature of markets, influenced by global events, economic trends, and investor sentiment, often leads to periods of volatility. For long-term investors, market fluctuations can be an opportunity rather than a setback. By employing the right strategies and mindset, long-term investors can navigate through uncertain […]

The Shift Toward Digital Investment Platforms in Modern Markets

The financial world is undergoing a profound transformation, with digital investment platforms taking center stage. These platforms are revolutionizing how people manage their wealth, offering unprecedented convenience, transparency, and access to global markets. The shift toward digital investment platforms is not merely a trend but a fundamental change in how individuals and institutions approach investing. […]

The Missing Link in Your Investment Success: Finding the Right Mutual Fund Distributor

We’ve all heard it before: “Investing is the first step towards securing your financial future.” But for many, the journey starts with confusion and uncertainty. The vast range of investment schemes available can be overwhelming, leaving us unsure about where to begin. We often question: Which funds should we choose? How do we balance risks […]

6 Types of Mutual Funds Based on Market Capitalisation

As India climbs to the rank of the fifth-largest global economy, the Indian mutual fund industry’s AUM has surged to an impressive Rs 57.26 lakh crore (AMFI, 30 April 2024) and continues to grow rapidly. Despite this growth, mutual fund penetration remains low, with only 4.5 crore investors in a country of 144 crore, representing […]